In today’s increasingly cashless world, many people are seeking financial tools that offer flexibility, security, and ease of use. Prepaid Chase is one such option, providing individuals with the ability to manage their money without needing a traditional bank account or credit history. Chase, one of the largest and most well-known financial institutions in the United States, offers a variety of prepaid card options designed to meet the needs of customers who may want to control their spending, avoid the risks of credit card debt, or simply manage their finances more efficiently.

In this article, we will explore what Prepaid Chase is, the benefits and features of Chase’s prepaid cards, how to apply for them, and common questions you may have about these cards.

Table of Contents

What Is Prepaid Chase?

Prepaid Chase refers to a set of prepaid card products offered by JPMorgan Chase, a major global financial services provider. A prepaid card works differently from traditional credit or debit cards. Instead of being linked to a bank account or a credit line, a prepaid card is preloaded with a set amount of funds that can be spent until the balance is depleted. Once the funds are used up, the cardholder can reload the card with more money if necessary.

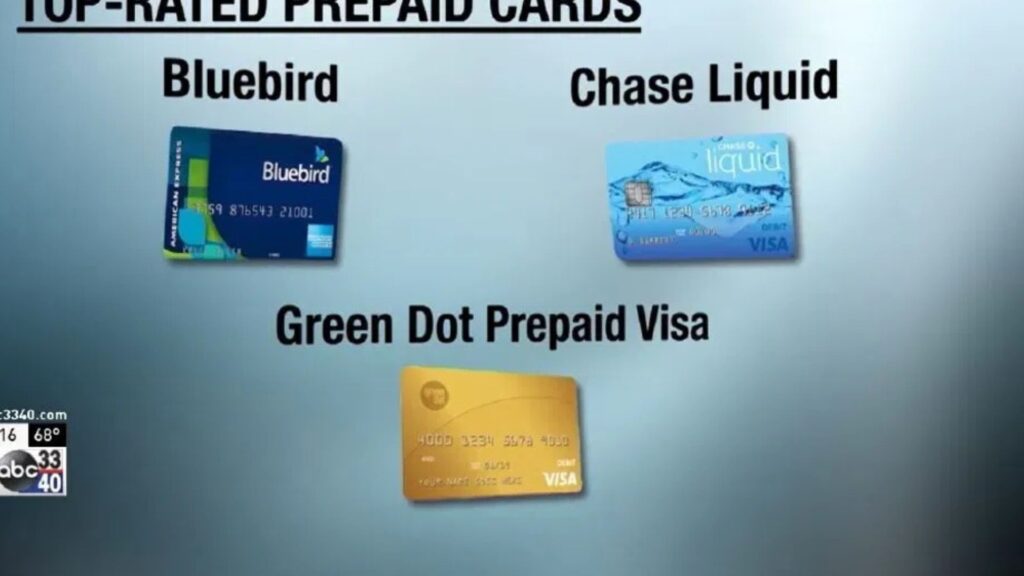

Chase offers several prepaid options, with the Chase Liquid® Prepaid Card being one of the most popular. This card is designed for people who want to manage their money without the complexities of a checking account or the risks of a credit card. It works just like a debit card but with no connection to a traditional bank account.

Key Features of Prepaid Chase

Chase’s prepaid card options come with a wide range of features designed to offer flexibility, security, and convenience. Below are some of the key features of the Prepaid Chase options.

1. No Monthly Fees with Chase Liquid® Prepaid Card

One of the standout features of the Prepaid Chase options is that there is no monthly maintenance fee for the Chase Liquid® Prepaid Card. Many traditional bank accounts charge monthly fees for maintaining an account, but with this prepaid card, you are only charged for specific services, such as ATM withdrawals or third-party reload fees. This makes the card an affordable alternative to other financial products.

2. Instant Reloading at Chase Branches

With Prepaid Chase, you have the ability to reload your card quickly and easily at any Chase branch. Whether you are transferring funds from your checking account or depositing cash, reloading your card is simple and instant. This feature adds a level of convenience that is not always available with other prepaid cards, which may require you to wait for your funds to clear before you can use them.

3. Free ATM Access

Another benefit of the Chase Liquid® Prepaid Card is free access to over 24,000 Chase ATMs across the United States. This feature makes it easy to withdraw cash without incurring any additional fees, which is often a concern with other prepaid cards or debit cards. If you need to access cash, you can do so at a Chase ATM with no hidden fees, which helps to make managing your finances more straightforward.

4. Direct Deposit and Bill Pay

Like a traditional bank account, the Chase Liquid® Prepaid Card allows you to set up direct deposit for your paycheck or government benefits. This means that you can have your funds added directly to your card, avoiding the need for paper checks and making your money available more quickly. Additionally, you can use your Prepaid Chase card for bill payments, making it a convenient solution for managing your recurring expenses.

5. Secure Transactions and Fraud Protection

Chase takes security seriously, offering robust protection for cardholders of Prepaid Chase cards. Just like other Chase products, your prepaid card is covered by the same fraud protection policies. If your card is lost or stolen, you can report it immediately, and Chase will work to prevent unauthorized transactions. The prepaid card also features EMV chip technology, providing an extra layer of security for in-person purchases.

6. Use Anywhere Visa or Mastercard Is Accepted

The Chase Liquid® Prepaid Card functions as either a Visa or Mastercard, meaning it is accepted anywhere those payment networks are used. Whether you’re shopping online, making purchases in person, or paying for services, your Prepaid Chase card works like a traditional debit card, giving you wide access to stores, merchants, and ATMs.

Benefits of Using a Prepaid Chase Card

There are several advantages to using Prepaid Chase, whether you’re trying to avoid bank fees, manage your budget, or simply need an alternative to cash. Below are some of the top benefits of using a Chase prepaid card.

1. No Bank Account Needed

A major benefit of Prepaid Chase is that you do not need a traditional checking account to use the card. This makes it a viable option for people who do not want to deal with the complexities of banking or for those who may not qualify for a checking account. You can use the prepaid card just like any other debit card, without the need for a bank.

2. Control Your Spending

Since you can only spend the amount that is loaded onto the card, Prepaid Chase helps you maintain better control over your spending. This can be especially helpful for people who are on a budget or looking to avoid the temptation of overspending. It’s also a useful tool for people who want to avoid accumulating debt, as there is no credit line attached to the card.

3. Perfect for Teens and Young Adults

Prepaid Chase is an excellent option for parents looking to provide their teens or young adults with a safe way to manage their money. Prepaid cards help teach kids about budgeting and financial responsibility without the risk of debt that comes with credit cards. Parents can even monitor spending through the online platform to ensure their child is using the card responsibly.

4. Ideal for Travelers

For those who travel frequently, Prepaid Chase offers a secure and convenient option for managing money. Since the Chase Liquid® Prepaid Card works like a Visa or Mastercard, it can be used internationally wherever these payment networks are accepted. It’s also a great way to avoid foreign transaction fees that are often associated with credit cards.

5. No Credit Check Required

One of the most attractive aspects of Prepaid Chase cards is that there is no credit check required to obtain a card. This means that people with no credit history or poor credit scores can still use a prepaid card to manage their finances. It also eliminates the need for a credit score review, making it easier to get started.

How to Apply for Prepaid Chase

Applying for a Prepaid Chase card is simple and can be done online or at a Chase branch. Here’s a step-by-step guide to getting started:

- Visit the Chase Website or Go to a Branch

You can apply for the Chase Liquid® Prepaid Card through the official Chase website or visit a nearby Chase branch to apply in person. - Complete the Application

Whether you apply online or in person, you’ll need to provide basic information, such as your name, address, and identification. The process is straightforward and doesn’t require a credit check. - Fund Your Card

Once you’ve received your card, you can load funds onto it either through direct deposit, by depositing money at a Chase branch, or using third-party reload services. - Start Using Your Card

After your funds are loaded, you can begin using the Prepaid Chase card immediately. Whether you’re shopping, paying bills, or withdrawing cash, your prepaid card works just like a debit card.

FAQs About Prepaid Chase

1. Does Prepaid Chase have any fees?

While the Chase Liquid® Prepaid Card has no monthly fee, there are fees associated with certain services, such as ATM withdrawals outside the Chase network and reloading funds through third-party services.

2. How do I check my balance on my Prepaid Chase card?

You can check your balance through the Chase mobile app, online banking, or by calling customer service.

3. Can I use the Chase Liquid® Prepaid Card for online purchases?

Yes, the card can be used for online shopping wherever Visa or Mastercard is accepted.

4. How can I reload my Prepaid Chase card?

You can reload your Prepaid Chase card through direct deposit, at any Chase branch, or via third-party reload networks.

5. Is my Prepaid Chase card protected from fraud?

Yes, Prepaid Chase cards come with fraud protection and are covered by Chase’s security features, including fraud alerts and zero-liability policies.

Conclusion

Prepaid Chase provides a convenient, secure, and easy-to-manage financial tool for individuals who want to avoid the complexities of traditional banking. Whether you’re looking for a way to budget, teach your children about money, or travel without worrying about credit card debt, Prepaid Chase offers a flexible solution. With its wide range of features and benefits, the Chase Liquid® Prepaid Card is an excellent choice for those seeking more control over their finances.