Getting your car repaired can be a stressful and expensive process, especially when unexpected repairs arise. Whether it’s a broken transmission, a failing alternator, or a simple brake replacement, auto repairs can quickly become costly. Many car owners wonder, do auto shops do payment plans to help manage these costs? Fortunately, the answer is yes—many auto shops offer payment plans to make car repairs more affordable and accessible for their customers.

In this article, we will explore how payment plans work in the context of auto repair services, the types of payment options available, and what you should know before opting for a payment plan. We will also address common questions regarding auto repair financing.

Table of Contents

What Are Payment Plans in Auto Shops?

A payment plan in an auto shop is essentially an agreement between you and the repair shop (or a third-party financing company) that allows you to pay for your car repairs in installments, rather than all at once. This is especially beneficial for individuals who may not have the funds to cover the full repair bill upfront but can manage smaller payments over time.

Payment plans vary from shop to shop and may involve different terms, such as interest rates, repayment schedules, and down payment requirements. Depending on the shop, you might have the option to either finance the entire cost of the repair or pay in installments over a set period. Many auto shops partner with third-party lenders or offer in-house financing to provide this service.

Types of Payment Plans Auto Shops Offer

There are several types of payment plans that auto repair shops may offer to their customers. These options range from in-house financing to using a third-party financing company. Here’s a look at some of the most common types of payment plans:

1. In-House Financing

Some auto repair shops provide in-house financing, which means the shop itself extends the payment plan. In-house financing may be simpler to obtain than using a third-party lender, as it doesn’t require a credit check or lengthy approval process. With in-house financing, the shop will typically allow you to pay for the repairs over several weeks or months, depending on the agreement. However, you should be aware of any potential interest rates, late fees, or penalties that could apply if you miss a payment.

2. Third-Party Financing

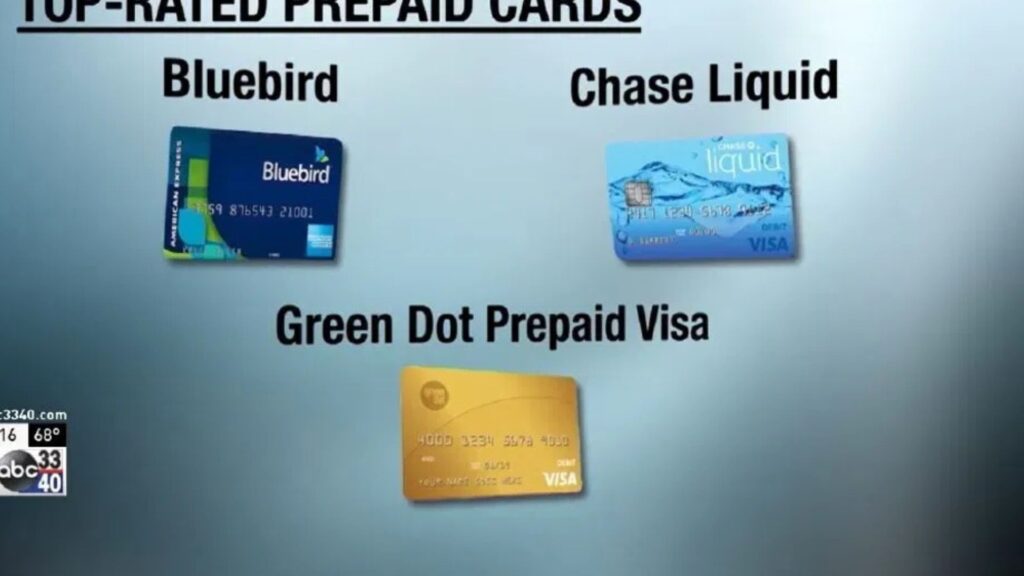

Many auto shops partner with third-party financing companies that specialize in offering loans or payment plans for auto repairs. These companies, such as CareCredit, Synchrony Financial, or Snap Finance, provide financing options for customers who need to break down their repair bills into smaller payments. Third-party financing companies typically offer flexible terms, such as low-interest rates, deferred interest, or promotional offers, depending on the agreement.

When choosing a third-party lender, make sure to review the terms and conditions carefully. Some lenders may offer no-interest or low-interest periods if paid within a certain timeframe, while others might charge higher interest rates or offer longer repayment periods.

3. Buy Now, Pay Later Services

Some auto shops also offer Buy Now, Pay Later (BNPL) options, which allow you to split the cost of your repair into manageable installments. BNPL services are often provided by companies like Affirm, Afterpay, or Klarna. These services typically allow you to make a payment within a few weeks or months and may be available at select auto repair shops that partner with these companies. BNPL services often have straightforward application processes and provide quick approval, making them an appealing option for some customers.

4. Credit Cards

In some cases, auto repair shops may accept credit cards for payment. If you don’t have enough money to pay for the repairs upfront but have access to a credit card, this can be an option. However, it’s important to be mindful of credit card interest rates, as they can be quite high if you carry a balance. Some auto shops may also offer credit cards that are specific to their shop or network, which may provide promotional financing or rewards for repairs.

Benefits of Payment Plans for Auto Repairs

Opting for a payment plan at an auto shop can offer several benefits, especially for customers who need assistance managing unexpected repair costs. Here are a few key advantages:

1. Affordable Monthly Payments

Instead of paying a large lump sum upfront, a payment plan allows you to spread the cost of repairs over time. This can make a significant difference in your monthly budget, especially if the repair bill is high.

2. Access to Immediate Repairs

A payment plan gives you the flexibility to get your car repaired as soon as possible, without having to wait until you have enough money to cover the full cost. This is particularly helpful if your car is essential for commuting to work or managing daily responsibilities.

3. No Need for a Loan

Payment plans can be an alternative to taking out a loan, especially if you have limited credit options. By breaking down the repair costs into installments, you can avoid the need for personal loans or high-interest credit card debt.

4. Improved Cash Flow

If you are budgeting for other expenses, payment plans allow you to better manage your cash flow. This can be especially beneficial for individuals with fixed incomes or those who are managing multiple financial obligations.

Things to Consider Before Choosing a Payment Plan

While payment plans can be helpful, it’s important to be aware of the potential downsides. Here are some things to consider before agreeing to a payment plan at an auto shop:

1. Interest Rates and Fees

Many payment plans, particularly those offered by third-party lenders, come with interest rates and fees. It’s crucial to read the fine print and understand the terms of the agreement before signing. In some cases, a payment plan may end up being more expensive than paying the full amount upfront.

2. Your Ability to Pay

Before committing to a payment plan, evaluate your ability to make the payments on time. Missing a payment could result in late fees, a higher interest rate, or even damage to your credit score if the financing company reports to credit bureaus.

3. Loan Terms

Different financing options come with varying terms, including repayment schedules and loan durations. Be sure to understand the repayment structure and whether you will be able to make the payments comfortably within the specified time frame.

4. Alternative Financing Options

If the payment plan offered by the auto shop isn’t ideal for your financial situation, consider looking into other financing options, such as personal loans, credit cards with 0% APR, or home equity lines of credit. Sometimes, these alternatives might offer better terms.

FAQs About Do Auto Shops Do Payment Plans?

1. Do all auto shops offer payment plans?

No, not all auto shops offer payment plans. While many larger or national auto repair chains do provide payment plan options, some smaller, independent shops may not. It’s always best to ask the shop if they offer financing or payment plans before committing to a repair.

2. How do I apply for a payment plan at an auto shop?

The application process for a payment plan varies depending on the shop. If the shop offers in-house financing, you may need to fill out an application form at the shop or online. For third-party financing, you will typically need to apply through the lender’s website or in partnership with the auto shop.

3. Are payment plans for auto repairs a good idea?

Payment plans can be a good option if you need to get your car repaired but don’t have the full amount available upfront. However, it’s important to carefully review the terms and ensure that you can manage the monthly payments before committing to a plan.

4. Can I get a payment plan for routine car maintenance?

Payment plans are typically available for major repairs rather than routine maintenance. However, some shops may offer financing options for larger services like tire replacements, brake jobs, or engine diagnostics. It’s worth inquiring with the auto shop about available financing for routine services.

5. Will using a payment plan affect my credit score?

Using a payment plan won’t automatically affect your credit score, but if you use a third-party financing company, the company may report your payment history to the credit bureaus. Timely payments may have a positive effect on your score, while missed payments could hurt it.

Conclusion

Do auto shops do payment plans? Yes, many auto shops do offer payment plans or financing options to help customers manage the cost of car repairs. Whether through in-house financing, third-party lenders, or Buy Now, Pay Later services, payment plans provide a flexible way to spread out the cost of repairs over time. Before agreeing to a payment plan, make sure to carefully review the terms, including interest rates and fees, to ensure it fits within your budget. With the right payment option, you can get the repairs your car needs without financial strain.